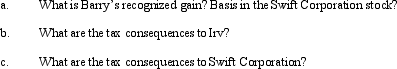

Barry and Irv form Swift Corporation.Barry transfers cash of $100,000 and equipment (basis of $300,000 and fair market value of $400,000)for 50% of Swift's stock.Irv transfers land and building (basis of $510,000 and fair market value of $450,000)and agrees to manage the business for one year for the other 50% of Swift's stock.The value of Irv's services for one year is $50,000.

Definitions:

Diminishing Returns

The principle where the increase in the quantity of input will, after a certain point, yield progressively smaller increases in output.

Costs Of Production

The total expenses incurred in the manufacturing of a product, including raw materials, labor, and overhead.

Input Prices

The costs or expenses incurred in acquiring the raw materials and services needed to produce a product.

Miles Per Gallon

A measure of fuel efficiency in vehicles, indicating how many miles a vehicle can travel on one gallon of fuel.

Q7: In September,Dorothy purchases a building for $900,000

Q8: In a U.S.District Court,a jury can decide

Q8: A shareholder lends money to his corporation

Q13: In a § 351 transaction,if a transferor

Q25: A tax preference increases alternative minimum taxable

Q28: Samantha owns stock in Pigeon Corporation (basis

Q38: Which court decisions are published in paper

Q64: Gray Company,a calendar year taxpayer,allows customers to

Q72: Megan's basis was $100,000 in the MAR

Q91: How can the positive AMT adjustment for