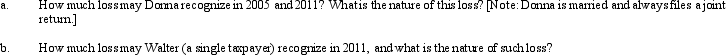

In 2004,Donna transferred assets (basis of $300,000 and fair market value of $250,000)to Egret Corporation in return for 200 shares of § 1244 stock.Due to § 351,the transfer was nontaxable; therefore,Donna's basis in the Egret stock is $300,000.In 2005,Donna sells 100 of these shares to Walter (a family friend)for $100,000.In 2011,Egret Corporation files for bankruptcy,and its stock becomes worthless.

Definitions:

Early Experiences

Formative events or exposures in the initial stages of life that significantly influence one's development, behavior, and personality.

Unresolved Conflicts

Issues or disagreements that have not been effectively addressed or resolved, potentially leading to ongoing tension and problems.

Emotionally Charged Memories

Recollections that are strongly associated with emotions, often more vivid and lasting.

Psychological Techniques

Broadly refers to methods or strategies employed within psychology to study the mind or address mental health issues.

Q1: Albert is considering two options for selling

Q6: Nigel purchased a blending machine for $125,000

Q36: The AMT does not apply to qualifying

Q55: Isabella and Marta form Pine Corporation.Isabella transfers

Q62: What are the tax consequences of a

Q76: Gold Corporation has accumulated E & P

Q98: Warbler Corporation,an accrual method regular corporation,was formed

Q103: In 2011,Bluebird Corporation had net income from

Q123: James and Kendis created the JK Partnership

Q130: An individual has a $10,000 § 1245