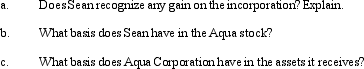

Sean,a sole proprietor,is engaged in a service business and uses the cash basis of accounting.In the current year,Sean incorporates his business by forming Aqua Corporation.In exchange for all of its stock,Aqua receives: assets (basis of $400,000 and fair market value of $2 million),trade accounts payable of $110,000,and loan due to a bank of $390,000.The proceeds from the bank loan were used by Sean to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Definitions:

Total Variable

Expenses that change in proportion to the activity of a business, such as costs of goods sold, which vary with the level of production or sales volume.

Average Variable Cost

The variable costs of production (costs that change with output level) divided by the quantity of output, indicating the average variable cost per unit.

Producing Purses

Producing purses involves the manufacturing and assembling of various materials to create handbags and similar accessories.

Average Fixed Cost

The sum of all production fixed costs divided by the number of units produced.

Q6: At a time when Blackbird Corporation had

Q9: One advantage of acquiring a corporation via

Q11: The transfer of an installment obligation in

Q39: The C corporation AMT rate can be

Q40: Katherine,the sole shareholder of Purple Corporation,a calendar

Q80: Teresa inherits land from her first cousin,Drew,in

Q87: Orange Corporation owns stock in White Corporation

Q115: The adjusted gross estate of Keith,decedent,is $6

Q117: Tungsten Corporation,a calendar year cash basis taxpayer,made

Q119: Which of the following comparisons is correct?<br>A)