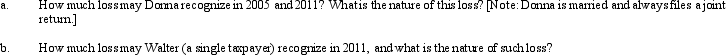

In 2004,Donna transferred assets (basis of $300,000 and fair market value of $250,000)to Egret Corporation in return for 200 shares of § 1244 stock.Due to § 351,the transfer was nontaxable; therefore,Donna's basis in the Egret stock is $300,000.In 2005,Donna sells 100 of these shares to Walter (a family friend)for $100,000.In 2011,Egret Corporation files for bankruptcy,and its stock becomes worthless.

Definitions:

Tax Deductible

Expenses that can be subtracted from gross income, lowering the taxable income and thus the amount of tax owed.

Investor's Perspective

The viewpoint or considerations of an individual or entity actively investing or planning to invest in markets, focusing on potential risks and returns.

Unusually Risky

Describes investments or actions that carry a higher than normal level of risk, often due to uncertain outcomes or volatile conditions.

IRRs

The Internal Rate of Return is a measurement used in the process of capital budgeting to assess the potential profitability of investments.

Q5: The gross estate of Raul,decedent who died

Q6: Nigel purchased a blending machine for $125,000

Q21: Most major tax services are available in

Q47: Which is presently not a major tax

Q72: Keosha acquires 10-year personal property to use

Q76: Shane made a contribution of property to

Q78: When searching on an online tax service,which

Q120: Aaron owns a 30% interest in a

Q125: Eula owns a mineral property that had

Q132: Sam's gross estate includes stock in Tern