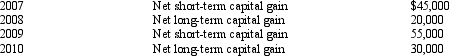

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2011.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 20117.

Compute the amount of Bear's capital loss carryover to 20117.

Definitions:

Passed By Legislature

A bill or proposed law that has been approved by both houses of a legislative body and is awaiting further action, such as executive approval, to become law.

Nash Equilibrium

Nash Equilibrium is a concept in game theory where each participant's strategy is optimal considering the strategies of other participants, implying no player has anything to gain by changing only their own strategy.

Prisoners' Dilemma

A scenario in game theory where two individuals acting in their own self-interest do not achieve the optimal outcome.

Payoffs

The outcomes or rewards received as a result of choosing a particular strategy or course of action.

Q26: Jade Corporation,a C corporation,had $100,000 operating income

Q38: Sarah and Tony (mother and son)form Dove

Q44: The Yellow Equipment Company,an accrual basis C

Q50: Yard Corporation,a cash basis taxpayer,received $10,000 from

Q61: Noncorporate shareholders may elect out of §

Q72: Which of the following statements regarding a

Q78: Albert,age 57,leased a house for one year

Q85: Four individuals form Chickadee Corporation under §

Q97: Peach Corporation had $210,000 of active income,$45,000

Q105: In 2011,the AMT exemption for a single