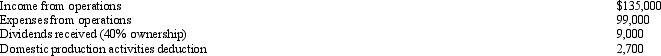

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Immediate Answer

A response given without delay, providing information or a decision right away.

Signature File

A small block of text automatically appended to the end of email messages, often containing the sender's name and contact information.

Formal Tone

A style of communication that is professional, polite, and adheres to conventional language standards, often used in business, academic, or official contexts.

Urethra

A tube that conveys urine from the bladder to the outside of the body in both males and females, and also transports semen in males.

Q2: To determine E & P,some (but not

Q13: In a § 351 transaction,if a transferor

Q38: Discuss the relationship between the postponement of

Q39: The only things that the grantee of

Q40: Maurice sells his personal use automobile at

Q44: To ensure the desired tax treatment,parties contemplating

Q61: A disadvantage to using the accrual method

Q89: Yellow,Inc.sold a forklift on April 12,2011,for $3,000

Q129: Casualty gains and losses from nonpersonal use

Q143: For § 1245 recapture to apply,accelerated depreciation