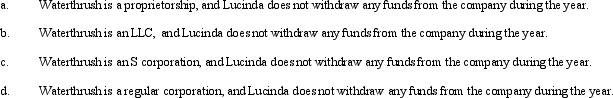

During the current year,Waterthrush Company had operating income of $510,000 and operating expenses of $400,000.In addition,Waterthrush had a long-term capital gain of $30,000.How does Lucinda,the sole owner of Waterthrush Company,report this information on her individual income tax return under following assumptions?

Definitions:

Autonomy

The right or condition of self-government, or in personal decision-making, the capacity to make an informed, uncoerced decision.

Legal Issue

A matter or dispute that concerns law or legal principles and requires legal knowledge to resolve.

Societal Norms

Shared expectations and rules that guide behavior within a society.

Common Law

The traditional unwritten law of England, based on custom and usage, which began to develop over a thousand years before the founding of the United States. Today, almost all common law has been enacted into statutes with modern variations by all the states except Louisiana, which is still influenced by the Napoleonic Code. In some states, the principles of common law are so basic they are applied without reference to statute.

Q1: In 2011,Helen sold equipment used in her

Q1: Real property subdivided for resale into lots,even

Q1: Similar to like-kind exchanges,the receipt of "boot"

Q8: In a U.S.District Court,a jury can decide

Q11: Hubert purchases Fran's jewelry store for $950,000.The

Q19: In the current year,Plum Corporation,a computer manufacturer,donated

Q27: Robert organized Redbird Corporation 10 years ago

Q78: Constructive dividends have no effect on a

Q80: The terms "earnings and profits" and "retained

Q124: The three tax statuses are:<br>A) Ordinary asset,