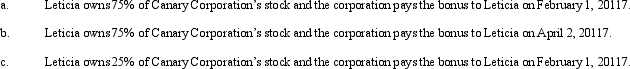

Canary Corporation,an accrual method C corporation,uses the calendar year for tax purposes.Leticia,a cash method taxpayer,is both a shareholder of Canary and the corporation's CFO.On December 31,2011,Canary has accrued a $100,000 bonus to Leticia.Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Under § 267(a)(2),an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income.For purposes of this limitation,a more-than-50% shareholder of the corporation is a related party.

Under § 267(a)(2),an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income.For purposes of this limitation,a more-than-50% shareholder of the corporation is a related party.

Definitions:

Factorial ANOVA

A statistical test used to determine the effect of two or more independent variables on a single continuous dependent variable.

Repeated-Measures ANOVA

A type of ANOVA used when the same subjects are observed under different conditions or at different time points, allowing for the analysis of within-subject variability.

Test Statistic

A calculated value from sample data used to make decisions in hypothesis testing, determining how far an observed statistic deviates from what is expected.

Statistical Procedure

A method or technique used for collecting, analyzing, interpreting, and presenting data.

Q1: In 2011,Helen sold equipment used in her

Q14: On December 20,2011,the directors of Quail Corporation

Q23: All of a corporation's AMT is available

Q37: Discuss the logic for mandatory deferral of

Q39: Technical Advice Memoranda may not be cited

Q49: Kim,a real estate dealer,and others form Eagle

Q79: Can AMT adjustments and preferences be both

Q89: Red Corporation,a C corporation that has two

Q100: Rose is a 50% partner in Wren

Q104: Ivory Corporation,a calendar year,accrual method C corporation,has