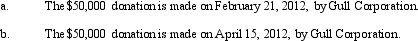

On December 30,2011,the board of directors of Gull Corporation,a calendar year,accrual method C corporation,authorized a contribution of $50,000 to a qualified charitable organization.For purposes of the taxable income limitation applicable to charitable deductions,Gull has taxable income of $420,000 and $370,000 for 2011 and 2012,respectively.Describe the tax consequences to Gull Corporation under the following independent situations.

Definitions:

Deindividuation

A psychological state where an individual loses self-awareness and self-restraint, often occurring in group settings.

Uniforms

Standardized clothing worn by members of an organization while participating in that organization's activity.

Benevolent Sexism

A form of sexism that is typically couched in terms that seem positive or affectionate but actually reinforce traditional gender roles and the idea that women are weaker or less competent than men.

Entrapment

A situation in which someone is induced to commit a crime they had no previous intention to commit, often as part of a law enforcement sting operation.

Q12: Kevin and Nicole form Indigo Corporation with

Q13: Louis owns a condominium in New Orleans

Q27: Under what circumstances may a partial §

Q36: Monty is in the business of painting.He

Q39: The only things that the grantee of

Q72: In the current year,Amber,Inc.,a calendar C corporation,has

Q82: In a § 351 transfer,a shareholder receives

Q101: Ed,an individual,incorporates two separate businesses that he

Q102: Are the AMT rates for the individual

Q113: If a gambling loss itemized deduction is