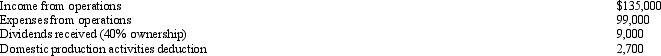

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Break-Even Point

The level of sales or production at which total revenues equal total expenses, resulting in no profit or loss for the business.

Sales

The total amount of goods or services sold by a company within a specific period, generating revenue.

Standard Bikes

Refers to bicycles that adhere to specific industry norms and standards, typically meant for average or typical use scenarios.

Fixed Costs

Costs that do not vary with the level of output or sales over the short term, such as rent or salaries.

Q5: Pat,Maria,and Lynn are equal shareholders in Lime

Q19: Inez's adjusted basis for 7,000 shares of

Q35: In order to encourage the development of

Q43: Sally and her mother are the sole

Q60: Sand Corporation,a calendar year taxpayer,has alternative minimum

Q77: Wallace owns a construction company that builds

Q78: For regular income tax purposes,Yolanda,who is single,is

Q90: Which of the following statements is incorrect

Q103: The MOP Partnership is involved in leasing

Q107: If the taxpayer elects to capitalize intangible