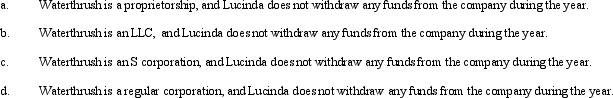

During the current year,Waterthrush Company had operating income of $510,000 and operating expenses of $400,000.In addition,Waterthrush had a long-term capital gain of $30,000.How does Lucinda,the sole owner of Waterthrush Company,report this information on her individual income tax return under following assumptions?

Definitions:

Simple Regression

A statistical method for quantifying the relationship between a single independent variable and a single dependent variable.

Intercept

In statistics and mathematics, the point at which a line crosses the y-axis in a graph, representing the value of the dependent variable when the independent variable is zero.

Error Term

The difference between observed values and estimated values in a statistical model.

Multicollinearity

A statistical phenomenon where two or more predictor variables in a multiple regression model are highly correlated, potentially distorting estimates.

Q20: Certain dividends from foreign corporations can be

Q24: Which of the following statements regarding the

Q34: Before a tax bill can become law,it

Q38: Danica owned a car that she used

Q48: House members have considerable latitude to make

Q57: Mitchell owned an SUV that he had

Q69: Ivory Fast Delivery Company,an accrual basis taxpayer,frequently

Q86: Patty's factory building,which has an adjusted basis

Q102: Nicholas is a 25% owner in the

Q135: Spencer has an investment in two parcels