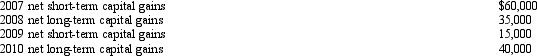

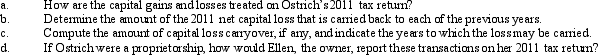

Ostrich,a C corporation,has a net short-term capital gain of $40,000 and a net long-term capital loss of $180,000 during 2011.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Complementary

Complementary refers to things that combine in such a way as to enhance or emphasize the qualities of each other or another.

Alternative Medicine

Practices claimed to have the healing effects of medicine but not supported by scientific evidence or established in the medical community.

HIV Infection

A virus that attacks the immune system, potentially leading to AIDS if not treated.

Bacterial Infections

Diseases caused by harmful bacteria entering the body, which can lead to a range of symptoms and may require antibiotic treatment.

Q1: Jose receives a nontaxable distribution of stock

Q4: Interest on a home equity loan may

Q14: What is the difference between the depreciation

Q49: Generally,deductions for additions to reserves for estimated

Q59: Eagle Company,a partnership,had a short-term capital loss

Q78: Owl Corporation,a C corporation,recognizes a gain on

Q84: Juanita owns 45% of the stock in

Q107: Mike is a self-employed TV technician.He is

Q115: If a taxpayer exercises an ISO and

Q129: Distributions by a corporation to its shareholders