Multiple Choice

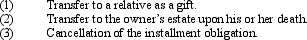

Which of the following is (are) a taxable disposition of an installment obligation?

Definitions:

Related Questions

Q32: Lois received nontaxable stock rights with a

Q33: The exercise of an incentive stock option

Q42: When current E & P has a

Q52: Melissa,age 58,marries Arnold,age 50,on June 1,2011.Melissa decides

Q69: Texas is in the jurisdiction of the

Q76: Rachel participates 150 hours in Activity A

Q79: Grackle Corporation (E & P of $600,000)distributes

Q80: Compare the basic tax and nontax factors

Q90: An individual has the following recognized gains

Q93: Almond Corporation,a calendar year C corporation,had taxable