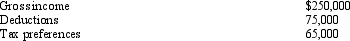

Applying the AMT rules,Lucinda has the following in 2011:  If Lucinda's regular income tax liability is $42,647,her AMTI is:

If Lucinda's regular income tax liability is $42,647,her AMTI is:

Definitions:

Self-Evaluation Maintenance

A psychological process where individuals adjust their perception of themselves based on their relationship and comparisons to others.

Relevance

The degree to which something is related or useful to the matter at hand, impacting how information or actions are perceived and valued.

Closeness

Refers to the emotional proximity or bonding between individuals.

Self-Control

The capacity of a person to control their feelings, ideas, and actions when confronted with desires and sudden urges.

Q10: Vireo Corporation redeemed shares from its sole

Q14: Which of the following is correct concerning

Q64: Gray Company,a calendar year taxpayer,allows customers to

Q65: Daisy Corporation is the sole shareholder of

Q72: Which of the following statements regarding a

Q77: Ramon sold land in 2011 with a

Q79: In January 2011,Tammy acquired an office building

Q86: Ned,a college professor,owns a separate business (not

Q104: Kelly,who earns a yearly salary of $120,000,sold

Q112: Blue Corporation,a cash basis taxpayer,has taxable income