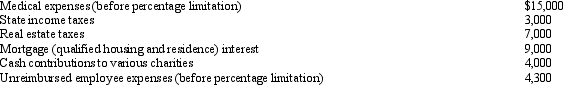

Mitch,who is single and has no dependents,had AGI of $100,000 in 2011.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2011?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2011?

Definitions:

Gender Differences

The distinctions in characteristics, behaviors, physical and psychological traits, roles, and status attributed to males and females by society and culture.

Communication Styles

The characteristic ways that individuals prefer to exchange information and converse with others.

Meeting Success

The achievement of predetermined objectives and goals during a meeting, leading to productive outcomes.

Language Policy

A set of guidelines and decisions designed to influence how languages are used within an educational, corporate, or governmental context.

Q6: Identify the types of income that are

Q26: Discuss the treatment of losses from involuntary

Q27: Robin Corporation distributes furniture (basis of $40,000;

Q38: Navy Corporation makes a property distribution to

Q51: Nondeductible meal and entertainment expenses must be

Q61: Original issue discount is amortized over the

Q66: Julio exchanges property,basis of $100,000 and fair

Q79: In 2011,Manuelo has $29,000 short-term capital loss,$10,000

Q117: Tungsten Corporation,a calendar year cash basis taxpayer,made

Q119: Which of the following comparisons is correct?<br>A)