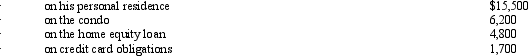

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2011,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2011,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2011?

What amount,if any,must Ted recognize as an AMT adjustment in 2011?

Definitions:

Reliability

The consistency and stability of test scores or measurements over time or across different occasions.

Validity

The extent to which a concept, conclusion, or measurement is well-founded and corresponds accurately to the real world.

Correlation Coefficients

Statistical measures that quantify the degree to which two variables are related or move together.

Predictive Validity

The extent to which a score on a scale or test predicts future performance on a related task.

Q1: Any unused general business credit must be

Q45: Property sold to a related party purchaser

Q45: Alice,Inc.,is an S corporation that has been

Q48: What special passive loss treatment is available

Q50: The holding period of property given up

Q51: Nondeductible meal and entertainment expenses must be

Q68: Which of the following correctly describes the

Q85: A business taxpayer sells inventory for $60,000.The

Q100: The AMT adjustment for research and experimental

Q104: Kelly,who earns a yearly salary of $120,000,sold