Multiple Choice

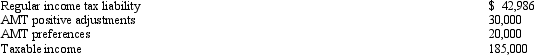

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2011.  Calculate his AMT for 2011.

Calculate his AMT for 2011.

Definitions:

Related Questions

Q21: Schedule M-2 is used to reconcile unappropriated

Q24: An individual taxpayer received a valuable antique

Q40: During its first year of operations,Sherry's business

Q43: Tina incorporates her sole proprietorship with assets

Q69: Discuss the relationship between realized gain and

Q71: Art owns significant interests in a hardware

Q80: Thomas transfers cash of $160,000 to Grouse

Q115: Section 1231 lookback losses may convert some

Q118: Cindy,who is single and has no dependents,has

Q119: Which of the following comparisons is correct?<br>A)