Essay

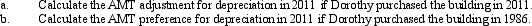

In September,Dorothy purchases a building for $900,000 to use in her business as a warehouse.Dorothy uses the depreciation method which will provide her with the greatest deduction for regular income tax purposes.

Definitions:

Related Questions

Q8: Under what circumstances are corporations exempt from

Q18: During the current year,Shrike Company had $220,000

Q26: To ease a liquidity problem,all of the

Q33: In a not essentially equivalent redemption [§

Q45: In the current year,Pink Corporation has a

Q82: For a building placed in service before

Q91: The tax benefits resulting from tax credits

Q102: Are the AMT rates for the individual

Q114: The tax treatment of corporate distributions at

Q116: Kay had percentage depletion of $119,000 for