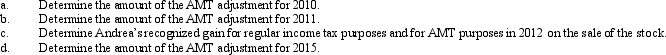

In May 2010,Egret,Inc.issues options to Andrea,a corporate officer,to purchase 200 shares of Egret stock under an ISO plan.At the date the stock options are issued,the fair market value of the stock is $900 per share and the option price is $1,200 per share.The stock becomes freely transferable in 2011.Andrea exercises the options in November 2010 when the stock is selling for $1,600 per share.She sells the stock in December 2012 for $1,800 per share.

Definitions:

Partners' Capital Statement

A financial report that shows the changes in each partner's equity in a partnership over a period of time.

Income Ratio

A financial metric comparing different aspects of income, such as net profit to sales, to assess profitability or performance.

Capital Deficiency

A scenario in which a company's debts surpass its possessions, suggesting a risk of not being able to meet its financial obligations.

Matching

An accounting principle that involves recognizing expenses in the same period as the revenues they helped generate, to accurately reflect profits.

Q3: Is it generally better to have a

Q4: Bronze Corporation sold machinery for $27,000 on

Q9: Rose's manufacturing plant is destroyed by fire

Q18: Ollie owns a personal use car for

Q27: Under what circumstances may a partial §

Q51: Briefly describe the charitable contribution deduction rules

Q54: Discuss the tax year in which an

Q54: Walter sold land (a capital asset)to an

Q71: A personal use property casualty loss is

Q88: What is the rationale underlying the tax