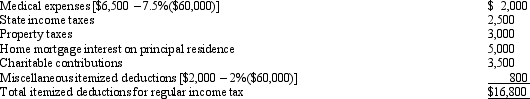

In calculating her taxable income,Rhonda deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Definitions:

Express Warranty

A clearly stated guarantee provided by a seller regarding the condition or quality of a product.

Implied Warranty

An unwritten, unstated guarantee that a product will meet basic standards of quality and reliability.

Express Warranty

A seller's explicit promise or guarantee, assuring the quality or performance of a product, often included in the written contract.

UCC

The Uniform Commercial Code, a comprehensive set of laws governing all commercial transactions in the United States, intended to harmonize the law among the states.

Q17: Roger owns and actively participates in the

Q32: Durell owns a construction company that builds

Q32: Cyan Company sold machinery for $55,000 on

Q47: Jonah owned a rental building (but not

Q65: Todd,a CPA,sold land for $200,000 plus a

Q69: Tom owns five activities,and he elects not

Q74: The dividends received deduction may be subject

Q82: In a § 351 transfer,a shareholder receives

Q90: Steve has a tentative general business credit

Q131: Section 1231 property generally does not include