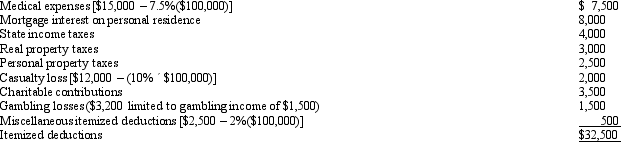

Luke's itemized deductions in calculating taxable income are as follows:

Definitions:

Central Nervous System

The complex of nerve tissues that controls the activities of the body, comprising the brain and spinal cord.

Dissociative Theory

A psychological theory explaining a disconnection and lack of continuity between thoughts, memories, surroundings, actions, and identity.

Cognitive Behavioral

A therapeutic approach that aims to change negative patterns of thinking or behavior that are contributing to a person's difficulties.

Night Terrors

Episodes of intense fear that occur during sleep, often involving screaming, thrashing, and a feeling of terror upon awakening.

Q5: Calico,Inc.,has AMTI of $305,000.Calculate the amount of

Q9: Lynne owns depreciable residential rental real estate

Q20: Joseph converts a building (adjusted basis of

Q21: Adam transfers cash of $300,000 and land

Q26: Charmine,a single taxpayer with no dependents,has already

Q35: The components of the general business credit

Q59: Joel placed real property in service in

Q75: If a taxpayer purchases taxable bonds at

Q81: A corporation's holding period for property received

Q112: Blue Corporation,a cash basis taxpayer,has taxable income