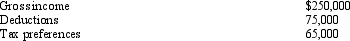

Applying the AMT rules,Lucinda has the following in 2011:  If Lucinda's regular income tax liability is $42,647,her AMTI is:

If Lucinda's regular income tax liability is $42,647,her AMTI is:

Definitions:

Langara College

A public college in Vancouver, British Columbia, Canada, offering university-transfer, career, and continuing studies programs.

3-Point Distance

A mathematical term likely related to calculating the distance between two points in a 3-dimensional space using the distance formula.

Registered Retirement Savings Plan

A Canadian account for holding savings and investment assets, with certain tax benefits aimed at retirement planning.

Income Tax Act

Legislation governing the taxation of income in a specific jurisdiction, outlining the regulations for income tax collection and enforcement.

Q41: Blue Corporation distributes property to its sole

Q47: What is the relationship between the regular

Q53: What effect do the assumption of liabilities

Q89: Which of the following can produce an

Q91: Kingbird Corporation (E & P of $800,000)has

Q96: Timothy owns 100% of Forsythia Corporation's stock.Corporate

Q97: Rental use depreciable real estate held more

Q101: Section 1231 applies to the sale or

Q120: What are the AMT rates for an

Q129: Casualty gains and losses from nonpersonal use