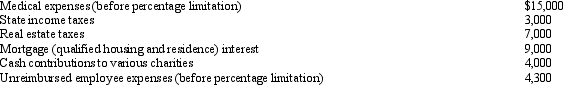

Mitch,who is single and has no dependents,had AGI of $100,000 in 2011.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2011?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2011?

Definitions:

Skills

Abilities or proficiencies developed through training or experience that enable effective performance in activities.

Standardized Questionnaires

These are structured forms used to collect data from respondents in a consistent manner, ensuring comparability and reliability across different respondents or groups.

Family

A social unit typically bound by kinship, affinity, or co-residence, that forms the primary arena for socialization and support.

Assessment Center Process

A method used by organizations to evaluate candidates' abilities through a series of exercises and simulations, typically for hiring or promotion decisions.

Q5: Peach Company,a closely held C corporation,incurs a

Q21: When a taxpayer disposes of a passive

Q24: Because passive losses are not deductible in

Q30: The Code contains two major depreciation recapture

Q37: On June 1,2011,Bruce purchased an option to

Q62: Hidasu is a mechanical engineer and,while unemployed,invents

Q79: Grackle Corporation (E & P of $600,000)distributes

Q83: In certain circumstances,the amount of dividend income

Q84: If the AMT base is greater than

Q135: In 2008,Floyd carried out a successful complete