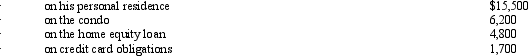

Ted,who is single,owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March 2011,he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During 2011,he paid the following amounts of interest:  What amount,if any,must Ted recognize as an AMT adjustment in 2011?

What amount,if any,must Ted recognize as an AMT adjustment in 2011?

Definitions:

Female Protégés

Women who are guided, supported, and mentored in their personal and professional development by a more experienced person.

Psychosocial Support

Support aimed at addressing psychological and social needs to improve an individual's emotional wellbeing.

Catharsis Hypothesis

The idea that expressing or getting out one's emotions, especially anger, can lead to a reduction in these feelings and promote psychological health.

Relative Deprivation

The perception that we are worse off relative to those with whom we compare ourselves.

Q15: Since services are not considered property under

Q34: A small employer incurs $1,400 for consulting

Q41: In 2011,Cashmere Construction Company enters into a

Q41: There is no Federal income tax assessed

Q41: Trudy forms Oak Corporation by transferring land

Q48: Since most tax preferences are merely timing

Q52: The bona fide business requirement of §

Q54: Eunice Jean exchanges land held for investment

Q73: Lark City donates land worth $300,000 and

Q96: Timothy owns 100% of Forsythia Corporation's stock.Corporate