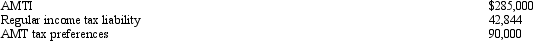

Caroline and Clint are married,have no dependents,and file a joint return in 2011.Use the following selected data to calculate their Federal income tax liability.

Definitions:

Perpetual Inventory System

An inventory management system where transactions are recorded in real-time, continuously updating inventory and cost of goods sold balances.

Q5: All collectibles long-term gain is subject to

Q29: The Seagull Partnership has three equal partners.Partner

Q39: Cheryl is single,has one child (age 6),and

Q53: Which of the following is correct?<br>A) Improperly

Q56: Canary Corporation,which sustained a $5,000 net capital

Q65: Kenton has investments in two passive activities.Activity

Q69: Ivory Fast Delivery Company,an accrual basis taxpayer,frequently

Q99: Frederick sells land and building whose adjusted

Q104: Section 1231 property generally includes certain intangible

Q123: Jackson sells qualifying small business stock for