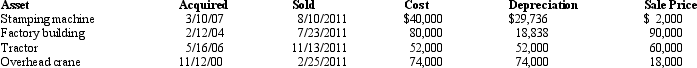

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Definitions:

Q5: Snow Corporation was a calendar year corporation

Q10: Gold Corporation,Silver Corporation,and Copper Corporation are equal

Q13: Louis owns a condominium in New Orleans

Q30: Wayne developed heart problems and was unable

Q32: In 2011,Dena traveled 545 miles for specialized

Q41: In March 2011,Gray Corporation hired two individuals,both

Q53: Currently,the Federal income tax is more progressive

Q66: Akeem,who does not itemize,incurred a net operating

Q78: Some (or all)of the tax credit for

Q82: For a building placed in service before