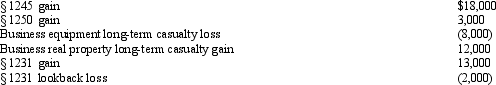

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Martin Luther King Jr.

A Baptist minister from America and activist who rose to prominence as the leading figure and voice in the civil rights movement from 1955 to his assassination in 1968.

Oratory Style

The distinctive manner or technique an individual uses when speaking publicly, often characterized by its effectiveness in persuading or moving an audience.

Legal Segregation

The practice of separating people or activities according to race by law, notably practiced in the United States until the mid-20th century.

African-American Fight

Refers to the enduring struggle of African Americans for justice, equality, and civil rights in the United States across various facets of society.

Q3: In computing the foreign tax credit,the greater

Q8: Walter traveled to another city to obtain

Q8: A provision in the law that compels

Q9: As to the AMT,a C corporation has

Q18: Ollie owns a personal use car for

Q22: In 2011,José,a widower,sells land (fair market value

Q27: Virginia had AGI of $100,000 in 2011.She

Q47: How is the donee's basis calculated for

Q65: Liz,who is single,travels frequently on business.Art,Liz's 84-year-old

Q132: The IRS is required to redetermine the