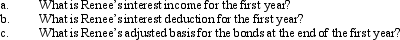

Renee purchases taxable bonds with a face value of $200,000 for $212,000.The annual interest paid on the bonds is $10,000.Assume Renee elects to amortize the bond premium.The total premium amortization for the first year is $1,600.

Definitions:

Net Cash

The amount of cash available after accounting for cash inflows and outflows, providing a clear picture of an entity's liquidity.

Investing Activities

Transactions and events that involve the acquisition or disposal of long-term assets and investments by a company.

Financing Activities

Transactions that result in changes in the size and composition of the equity and borrowings of a company.

Direct Method

A cash flow statement preparation approach that lists major classes of gross cash receipts and payments.

Q21: When a taxpayer disposes of a passive

Q31: Carol pays the medical expenses of her

Q31: Ed and Cheryl have been married for

Q37: On June 1,2011,Bruce purchased an option to

Q38: Danica owned a car that she used

Q64: Short-term capital losses are netted against long-term

Q84: Juanita owns 45% of the stock in

Q99: Gambling losses may be deducted to the

Q105: Jerry pays $5,000 tuition to a parochial

Q121: As it is consistent with the wherewithal