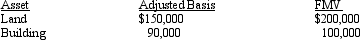

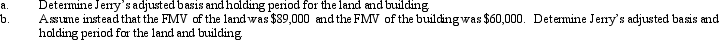

On September 18,2011,Jerry received land and a building from Ted as a gift.Ted had purchased the land and building on March 5,2008,and his adjusted basis and the fair market value at the date of the gift were as follows:

Ted paid gift tax on the transfer to Jerry of $96,000.

Ted paid gift tax on the transfer to Jerry of $96,000.

Definitions:

Save Button

An icon or option in software that allows the user to save their current work or progress.

Quick Access Toolbar

A customizable toolbar in software applications that provides quick access to commonly used commands and features.

Comparison Operators

Symbols used in programming and mathematics to compare two values, determining their relationship (equal, greater than, less than, etc.).

Compound Conditions

A logical situation where two or more conditions must be met for an action to take place, often used in programming and database queries.

Q11: Alex has three passive activities with at-risk

Q19: In terms of probability,which of the following

Q30: Is it possible that no AMT adjustment

Q37: Ken has a $40,000 loss from an

Q38: Computer Consultants Inc.,began business as an adviser

Q40: Pink Corporation is an accrual basis taxpayer

Q48: Green Company,in the renovation of its building,incurs

Q88: Gail exchanges passive Activity A,which has suspended

Q89: Discuss the effect of a liability assumption

Q116: Kay had percentage depletion of $119,000 for