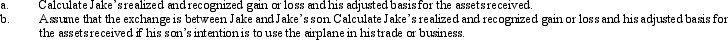

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Definitions:

Chemical Changes

Transformations in matter that result in the formation of new substances with different properties from the original substances.

Brain Rhythms

Patterns of neuronal activity in the brain that can manifest as oscillatory waves across various frequencies, essential for various aspects of brain function including sleep, cognition, and sensory processing.

Expectations

Preconceived notions or beliefs about what will happen or is likely to happen in the future.

Stress

A physical and emotional response to demands or challenges, which may come from work, relationships, or other aspects of life.

Q9: Which of the following statements is incorrect

Q33: Shareholders of closely held C corporations frequently

Q44: How can interest on a private activity

Q64: Short-term capital losses are netted against long-term

Q64: Evelyn's office building is destroyed by fire

Q83: In May 2011,Blue Corporation hired Camilla,Jolene,and Tyrone,all

Q91: Jake,the sole shareholder of Peach Corporation,a C

Q94: Employee business expenses for travel qualify as

Q94: Lea purchased for $1,310 a $2,000 bond

Q104: Section 1231 property generally includes certain intangible