Essay

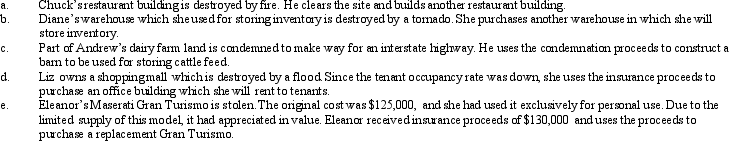

For each of the following involuntary conversions,determine if the property qualifies as replacement property.

Definitions:

Related Questions

Q8: A provision in the law that compels

Q15: A taxpayer's earned income credit is dependent

Q45: Property sold to a related party purchaser

Q48: In the case of an accrual basis

Q71: For purposes of computing the deduction for

Q91: How can the positive AMT adjustment for

Q122: For Federal income tax purposes,there never has

Q144: Ramon is in the business of buying

Q146: Which,if any,of the following is a typical

Q155: The FICA tax (Medicare component)on wages is