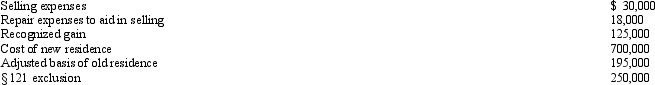

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Energy Star

A program run by the U.S. Environmental Protection Agency that certifies buildings and products for energy efficiency.

Instagram Posts

Content published on the Instagram platform, including photos, videos, and stories shared by users.

Intelligent Workplace

An environment enhanced with technology that facilitates efficient and flexible work practices.

Online Collaboration

The practice of working with others through the internet on shared projects or documents.

Q17: Under the "check-the-box" Regulations,a single-member LLC that

Q21: When a taxpayer disposes of a passive

Q28: Bjorn owns a 60% interest in an

Q43: Anita owns Activity A which produces active

Q45: In 2011,Brandon,age 72,paid $3,000 for long-term care

Q56: In 2011,Satesh has $4,000 short-term capital loss,$14,000

Q91: Samuel's hotel is condemned by the City

Q92: During the current year,Vijay,a self-employed individual,paid the

Q93: Almond Corporation,a calendar year C corporation,had taxable

Q99: A taxpayer is considered to be a