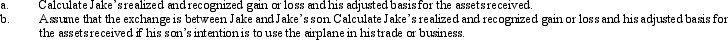

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Definitions:

IRR

Internal Rate of Return, a metric used to estimate the profitability of potential investments.

Initial Cost

The original cost of acquiring an asset before any depreciation, amortization, or similar adjustment.

Cash Inflows

The total amount of money received by a company or individual during a set period.

Payback Period

The duration of time it takes to recover the cost of an investment, calculated as the point where net cash flow equals the initial investment.

Q7: The buyer and seller have tentatively agreed

Q15: Involuntary conversion gains may not be deferred

Q16: Lease cancellation payments received by a lessor

Q40: During its first year of operations,Sherry's business

Q61: If the cost of a building constructed

Q67: From January through November,Vern participated for 420

Q76: Sandstone,Inc.,has consistently included some factory overhead as

Q83: An S corporation's tax year,generally,is determined by

Q92: Discuss the purpose of Schedule M-1.Give two

Q133: Which of the following real property could