Essay

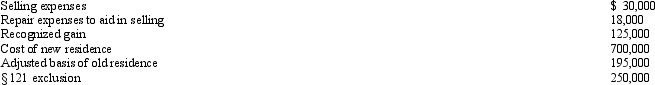

Use the following data to determine the sales price of Etta's principal residence and the realized gain.She is not married.The sale of the old residence qualifies for the § 121 exclusion.

Define and differentiate between pre-literacy, emergent literacy, phonemic awareness, and shared reading.

Acknowledge the differences in learning outcomes between full-day and half-day kindergarten programs.

Identify factors that influence the effectiveness of daycare and preschool experiences on child development.

Examine the impact of educational television on reading and writing skills development.

Definitions:

Related Questions

Q12: Calculate the AMT exemption for 2011 if

Q14: Which of the following is correct concerning

Q42: Define an involuntary conversion.

Q50: Which of the following statements is true

Q53: What effect do the assumption of liabilities

Q84: On January 10,2011,Wally sold an option for

Q86: Red Corporation and Green Corporation are equal

Q87: Sandy has the following results of netting

Q122: Bianca and Barney have the following for

Q141: A lease cancellation payment received by a