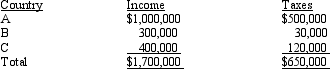

Summer Corporation's business is international in scope and is subject to income taxes in several countries.Summer's earnings and income taxes paid in the relevant foreign countries are:

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

If Summer Corporation's worldwide income subject to taxation in the United States is $2,400,000 and the U.S.income tax due prior to the foreign tax credit is $816,000,compute the allowable foreign tax credit.If,instead,the total foreign income taxes paid were $550,000,compute the allowable foreign tax credit.

Definitions:

Ratchet

A mechanical device consisting of a wheel or bar with teeth, allowing movement in one direction while preventing movement in the opposite direction, or colloquially, a situation or process that is perceived to be deteriorating or declining.

Forceps

A handheld, hinged instrument used in surgical procedures for grasping, holding firmly, or extracting something within the body.

Clamping

The process of holding or securing objects tightly together using a device to prevent movement or separation.

Grasping

The action of seizing or holding firmly, often used to describe the development of motor skills in infants or for understanding concepts.

Q1: Employees who render an adequate accounting to

Q15: Due to the population change,the Goose Creek

Q19: Cathy takes five key clients to a

Q23: A taxpayer who meets the age requirement

Q35: If the regular income tax deduction for

Q44: What is the easiest way for a

Q44: A deduction for parking and other traffic

Q51: If a taxpayer chooses not to claim

Q82: Eduardo was injured in a diving accident

Q92: The Federal income tax is based on