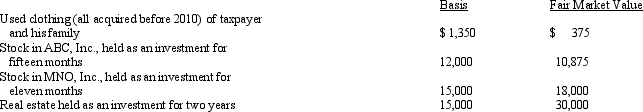

Zeke made the following donations to qualified charitable organizations during 2011:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2011 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2011 is:

Definitions:

Abstract of Title

a summary or condensed version of the legal history of an asset, particularly real estate, detailing transfers, encumbrances, and any litigation concerning the property.

Public Records

Documents or pieces of information that are not considered confidential and are stored by public agencies, accessible by the general public.

Title Insurance

A form of insurance that protects against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage loans.

Recorded Deed

A deed that has been officially entered into the public records, ensuring its validity and informing interested parties of the transfer of property rights.

Q6: Identify the types of income that are

Q12: In the current year,Rich has a $40,000

Q41: In March 2011,Gray Corporation hired two individuals,both

Q51: Upon the recommendation of a physician,Ed has

Q66: Sam sells land with an adjusted basis

Q76: Harold is a head of household,has $27,000

Q100: Losses on rental property are classified as

Q103: Assume a building is subject to §

Q104: On May 2,2012,Karen placed in service a

Q105: When Congress enacts a tax cut that