Multiple Choice

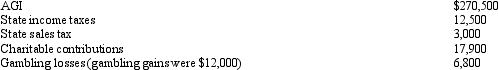

Alan,a calendar year married taxpayer,files a joint return for 2011.Information for 2011 includes the following:  Alan's allowable itemized deductions for 2011 are:

Alan's allowable itemized deductions for 2011 are:

Definitions:

Related Questions

Q12: Regarding § 222 (qualified higher education deduction

Q38: For purposes of computing the credit for

Q43: Anita owns Activity A which produces active

Q49: In 2011,Dorothy drove 500 miles to volunteer

Q49: Allowing a domestic production activities deduction for

Q103: If an election is made to defer

Q106: Any personal expenditures not specifically allowed as

Q112: Percentage depletion enables the taxpayer to recover

Q120: Cason is filing as single and has

Q128: A fixture will be subject to the