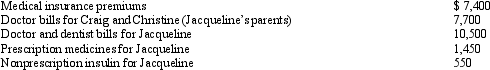

Jacqueline is employed as an architect.For calendar year 2011,she had AGI of $200,000 and paid the following medical expenses:

Craig and Christine would qualify as Jacqueline's dependents except that they file a joint return.Jacqueline's medical insurance policy does not cover them.Jacqueline filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2011 and received the reimbursement in January 2012.What is Jacqueline's maximum allowable medical expense deduction for 2011?

Craig and Christine would qualify as Jacqueline's dependents except that they file a joint return.Jacqueline's medical insurance policy does not cover them.Jacqueline filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2011 and received the reimbursement in January 2012.What is Jacqueline's maximum allowable medical expense deduction for 2011?

Definitions:

Direct Labor Hours

The total hours worked by employees directly involved in the manufacturing process or providing services.

Budgeted Costs

Predicted or planned expenses that are outlined in a company's budget for a specific period.

Fabricating Department

The division within a manufacturing company where raw materials are assembled or processed into finished goods.

Assembling Department

A section within a manufacturing facility where components are put together to form a final product.

Q1: Taxes assessed for local benefits,such as a

Q31: Five years ago,Tom loaned his son John

Q31: Section 1250 depreciation recapture will apply when

Q54: Once the more-than-50% business usage test is

Q64: If rental property is completely destroyed,the amount

Q64: If certain conditions are met,a buyer may

Q73: Martha is single with one dependent and

Q85: A business taxpayer sells inventory for $60,000.The

Q100: Nathan owns Activity A,which produces income,and Activity

Q138: Allowing for the cutback adjustment (50% reduction