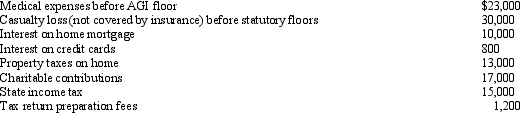

For calendar year 2011,Jon and Betty Hansen file a joint return reflecting AGI of $280,000.Their itemized deductions are as follows:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Breakeven Price

The market price at which the total costs of production equal the revenue derived from selling a product, resulting in neither profit nor loss.

Sale Price

The final amount at which a product or service is sold to consumers.

Marked Up

Refers to an increase in the selling price of goods or services, typically to create a profit margin above the cost.

Operating Expenses

Costs that a business incurs through its normal business operations, such as wages, rent, and utilities.

Q36: Helen pays nursing home expenses of $3,000

Q44: George purchases used seven-year class property at

Q51: On September 18,2011,Jerry received land and a

Q54: Tony is married and files a joint

Q58: Discuss the criteria used to determine whether

Q65: The amount of a loss on insured

Q96: Tangerine Corporation,a closely held (non-personal service)C corporation,earns

Q102: Caroyl made a gift to Tim of

Q108: A worker may prefer to be classified

Q146: Which,if any,of the following is a typical