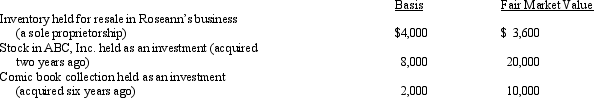

In 2011,Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2011 is:

The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2011 is:

Definitions:

Operating Activities

Activities that constitute the primary or main activities of a business, including sales, services, and day-to-day operations.

Merchandise Inventory

The total value of a retailer's or wholesaler's goods on hand at the end of an accounting period, available for sale to customers.

Accounts Payable

Money owed by a company to its suppliers or creditors for goods and services received but not yet paid for.

Indirect Method

A method used in cash flow statements to convert net income into net cash flow from operating activities by adjusting for non-cash transactions and changes in working capital.

Q30: Amanda uses a delivery van in her

Q34: A small employer incurs $1,400 for consulting

Q37: James purchased a new business asset (three-year

Q52: Elsie lives and works in Detroit.She is

Q63: A purchased trademark is a § 197

Q67: Under what circumstances will a distribution by

Q80: Discuss the treatment given to suspended passive

Q92: Employers are encouraged by the work opportunity

Q122: For Federal income tax purposes,there never has

Q136: Ranja acquires $200,000 face value corporate bonds