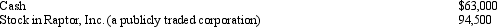

During 2011,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2011 is $189,000.What is Ralph's charitable contribution deduction for 2011?

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2011 is $189,000.What is Ralph's charitable contribution deduction for 2011?

Definitions:

Indirect Labor

Labor costs not directly associated with the production of goods or services, such as salaries of supervisors or maintenance staff.

Product Costs

All costs directly tied to the creation of a product, including materials, labor, and allocated overhead.

Materials Overhead

Costs related to the production process that are not directly tied to the product being manufactured, such as factory supplies and equipment maintenance.

Raw Materials

Basic materials used in the production process to create goods and products.

Q2: Child and dependent care expenses include amounts

Q6: Which,if any,of the following correctly describes the

Q27: Which of the following decreases a taxpayer's

Q62: A CPA firm in California sends many

Q75: Before the Sixteenth Amendment to the Constitution

Q76: Harold is a head of household,has $27,000

Q78: Ron and Tom are equal owners in

Q125: Due to a merger,Allison transfers from Miami

Q133: Meg teaches the fifth grade at a

Q153: Which of the following is a characteristic