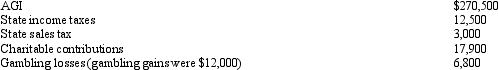

Alan,a calendar year married taxpayer,files a joint return for 2011.Information for 2011 includes the following:  Alan's allowable itemized deductions for 2011 are:

Alan's allowable itemized deductions for 2011 are:

Definitions:

Minimum Percentage

The lowest allowable or required fraction or rate of a quantity, often set as a standard or threshold.

Assets

Resources owned by a company, regarded as having value and available to meet debts, commitments, or legacies.

Invest

The action of allocating resources, usually financial, with the expectation of achieving a profit or material result.

ESOPs

Employee Stock Ownership Plans; these provide company stocks to employees as part of a retirement plan or incentive program.

Q9: In terms of meeting the distance test

Q35: Once set for a year,when might the

Q36: Cardinal Company incurs $800,000 during the year

Q43: As a matter of administrative convenience,the IRS

Q53: Grace's sole source of income is from

Q74: A taxpayer who claims the standard deduction

Q95: One of the tax advantages of being

Q114: Rocky has a full-time job as an

Q115: Section 1231 lookback losses may convert some

Q144: Under a state inheritance tax,two heirs,a cousin