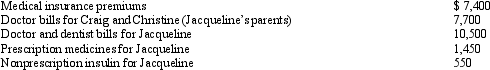

Jacqueline is employed as an architect.For calendar year 2011,she had AGI of $200,000 and paid the following medical expenses:

Craig and Christine would qualify as Jacqueline's dependents except that they file a joint return.Jacqueline's medical insurance policy does not cover them.Jacqueline filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2011 and received the reimbursement in January 2012.What is Jacqueline's maximum allowable medical expense deduction for 2011?

Craig and Christine would qualify as Jacqueline's dependents except that they file a joint return.Jacqueline's medical insurance policy does not cover them.Jacqueline filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2011 and received the reimbursement in January 2012.What is Jacqueline's maximum allowable medical expense deduction for 2011?

Definitions:

Q5: Under the automatic mileage method,one rate does

Q9: Pat died this year.Before she died,Pat gave

Q14: In the current year,Lucile,who has AGI of

Q48: Section 1239 (relating to the sale of

Q58: Discuss the criteria used to determine whether

Q59: When contributions are made to a Roth

Q78: Section 1231 property includes nonpersonal use property

Q109: Bob lives and works in Newark,NJ.He travels

Q119: Edna lives and works in Cleveland.She travels

Q143: Property can be transferred within the family