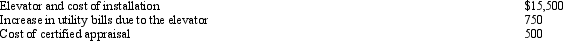

Timothy suffers from heart problems and,upon the recommendation of a physician,has an elevator installed in his personal residence.In connection with the elevator,Timothy incurs and pays the following amounts during the current year:

The system has an estimated useful life of 20 years.The appraisal was to determine the value of Timothy's residence with and without the system.The appraisal states that the system increased the value of Timothy's residence by $2,000.How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation)in the current year?

The system has an estimated useful life of 20 years.The appraisal was to determine the value of Timothy's residence with and without the system.The appraisal states that the system increased the value of Timothy's residence by $2,000.How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation)in the current year?

Definitions:

Production Phase

The production phase is the period in a business cycle when raw materials are converted into finished products.

Revenue Recognition

The principle in accounting that outlines the exact situations in which revenue is to be acknowledged and accounted for.

Transitory Earnings

Earnings that are considered temporary or not expected to persist over time, often removed from projections or models that attempt to predict a company's future profitability.

Extraordinary Loss

Unusual and infrequent charges that are reported separately on a company's income statement, outside of its regular business operations.

Q19: Tan Company acquires a new machine (ten-year

Q22: Several years ago,Sarah purchased a structure for

Q35: Bonnie purchased a new business asset (five-year

Q40: In May 2007,Alma incurred qualifying rehabilitation expenditures

Q57: Sarah purchased for $100,000 a 10% interest

Q58: In contrasting the reporting procedures of employees

Q73: Martha is single with one dependent and

Q100: Nathan owns Activity A,which produces income,and Activity

Q108: In 2011,Gail had a § 179 deduction

Q130: An individual has a $10,000 § 1245