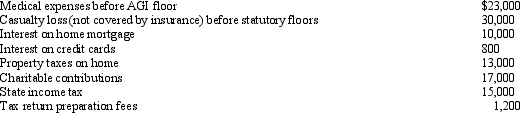

For calendar year 2011,Jon and Betty Hansen file a joint return reflecting AGI of $280,000.Their itemized deductions are as follows:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Active Voice

A sentence structure where the subject performs the action stated by the verb, making the writing clear and direct.

Passive Voice

A grammatical voice where the subject is the recipient of the action, often making the sentence less direct.

Shortening Sentences

The practice of making sentences briefer while retaining their original meaning.

Dependent Clause

A part of a sentence that cannot stand alone because it does not express a complete thought.

Q49: Seth had interest income of $31,000,investment expenses

Q49: Both traditional and Roth IRAs possess the

Q50: The annual exclusion,currently $13,000,is available for gift

Q54: Tony is married and files a joint

Q65: Liz,who is single,travels frequently on business.Art,Liz's 84-year-old

Q72: For self-employed taxpayers,travel expenses are not subject

Q78: Tara owns a shoe store and a

Q86: In a farming business,MACRS straight-line cost recovery

Q110: For the negligence penalty to apply,the underpayment

Q135: Morgan inherits her father's personal residence including