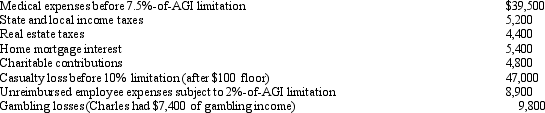

Charles,who is single,had AGI of $400,000 during 2011.He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Infants

Very young children, typically from birth to one year old, characterized by rapid physical and cognitive development.

Immigrants

Immigrants are people who have moved to a country other than their native one with the intention of settling there, often in search of better living conditions or job opportunities.

Economy

The system of production, distribution, and consumption of goods and services within a particular region or country.

Financially

Pertaining to finances or monetary resources, often used in the context of managing money or economic status.

Q14: In the case of an office in

Q26: Discuss the treatment of losses from involuntary

Q78: Tara owns a shoe store and a

Q80: Bjorn contributed a sculpture to the Minnesota

Q84: On January 10,2011,Wally sold an option for

Q87: Shirley pays FICA (employer's share)on the wages

Q92: The 2010 "Qualified Dividends and Capital Gain

Q93: Rustin bought used 7-year class property on

Q98: Discuss the tax consequences of listed property

Q140: What are the pros and cons of