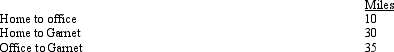

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year,she is permanently assigned to the team auditing Garnet Corporation.As a result,every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months,Amy's deductible mileage for each workday is:

For these three months,Amy's deductible mileage for each workday is:

Definitions:

Infancy

The stage in human development that spans from birth to 24 months, characterized by rapid physical and cognitive growth.

Inborn Cognitive Capabilities

Innate mental abilities or brain functions present from birth, influencing learning, understanding, and contextual adaptation.

Piaget

A Swiss psychologist known for his pioneering work in child development, particularly his theory of cognitive development stages.

Researchers

Individuals who conduct systematic investigations and studies to discover or interpret new knowledge across various academic and scientific fields.

Q19: Cathy takes five key clients to a

Q20: The amortization period in 2012 for $4,000

Q34: Discuss the treatment,including the carryback and carryforward

Q36: Janice is single,had gross income of $38,000,and

Q49: Barry purchased a used business asset (seven-year

Q55: On April 15,2012,Sam placed in service a

Q73: In 2010,Juan and Juanita incur $9,800 in

Q88: Which of the following can be claimed

Q103: If an election is made to defer

Q125: Due to a merger,Allison transfers from Miami