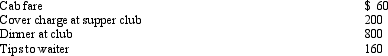

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation,Henry's deduction is:

Presuming proper substantiation,Henry's deduction is:

Definitions:

More Energy

The increased capacity for physical or mental activity due to improved health, nutrition, or lifestyle changes.

Muscle-Training Program

A structured plan of physical activities focused on increasing muscle strength and endurance.

Increased Body Fat

Refers to a higher than normal amount of fat in the body, which can lead to various health issues.

Muscle Mass

The total amount of skeletal muscle in the body, which can be increased through exercise and affects metabolism and physical strength.

Q7: Petal,Inc.is an accrual basis taxpayer.Petal uses the

Q11: Alex has three passive activities with at-risk

Q21: When a taxpayer disposes of a passive

Q22: Last year,Sarah (who files as single)had silverware

Q47: Augie purchased one new asset during the

Q50: In January,Lance sold stock with a cost

Q60: Golden Corporation is an eligible small business

Q69: David,a single taxpayer,took out a mortgage on

Q78: The taxpayer incorrectly took a $5,000 deduction

Q87: All employment related expenses are classified as