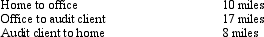

Bill is employed as an auditor by a CPA firm.On most days,he commutes by auto from his home to the office.During one month,however,he has an extensive audit assignment closer to home.For this engagement,Bill drives directly from home to the client's premises and back.Mileage information is summarized below:

If Bill spends 21 days on the audit,what is his deductible mileage?

If Bill spends 21 days on the audit,what is his deductible mileage?

Definitions:

Reduced Cell Elasticity

A decline in the ability of cells to return to their original shape after being stretched or compressed, often associated with aging or disease.

Medical Asepsis

Practices aimed at reducing the number and spread of pathogens in medical settings to prevent infection.

Urinary Catheterization

The insertion of a catheter into the bladder through the urethra to drain urine, often used for medical conditions that impair natural urination.

Parenteral Medications

Medicines administered bypassing the gastrointestinal tract, typically through injections.

Q19: Cathy takes five key clients to a

Q27: Cost depletion is determined by multiplying the

Q31: If part of a shareholder/employee's salary is

Q44: Sandra sold 500 shares of Wren Corporation

Q50: A theft loss of investment property is

Q76: The basis of cost recovery property must

Q81: Skeeter invests in vacant land for the

Q83: In May 2011,Blue Corporation hired Camilla,Jolene,and Tyrone,all

Q87: All employment related expenses are classified as

Q105: Members of a research team must include