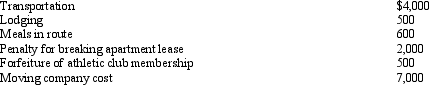

Marcie moved from Oregon to West Virginia to accept a better job.She incurred the following unreimbursed moving expenses:

What is Nicole's moving expense deduction?

What is Nicole's moving expense deduction?

Definitions:

Backache

A common physical discomfort or pain felt in the back, often resulting from strain, injury, or other health conditions.

Search Properties

Attributes of a product or service that can be easily evaluated before purchase, such as color or price.

Clothing

Clothing refers to garments or attire worn on the body for protection, adornment, or social signaling, encompassing a wide range of styles and functions.

TV Repair

The process of diagnosing and fixing problems with television sets, usually performed by specialized technicians.

Q2: In the current year,Abby has AGI of

Q6: In some cases it may be appropriate

Q7: Petal,Inc.is an accrual basis taxpayer.Petal uses the

Q11: Hobby activity expenses are deductible from AGI

Q24: Red Corporation incurred a $15,000 bad debt

Q67: During any month in which both the

Q88: Sally is an employee of Blue Corporation.Last

Q89: Which,if any,of the following expenses is subject

Q100: If an activity involves horses,a profit in

Q148: Federal excise taxes that are no longer